The Sweet Life of Bettajelly

Exploring delicious recipes, fun food trends, and lifestyle tips that bring joy to your everyday.

Budgeting Like a Boss: How to Turn Pennies into Possibilities

Unlock the secrets of savvy saving! Discover how to turn your pennies into endless possibilities with expert budgeting tips and tricks.

Maximizing Your Savings: 10 Tips for Smart Budgeting

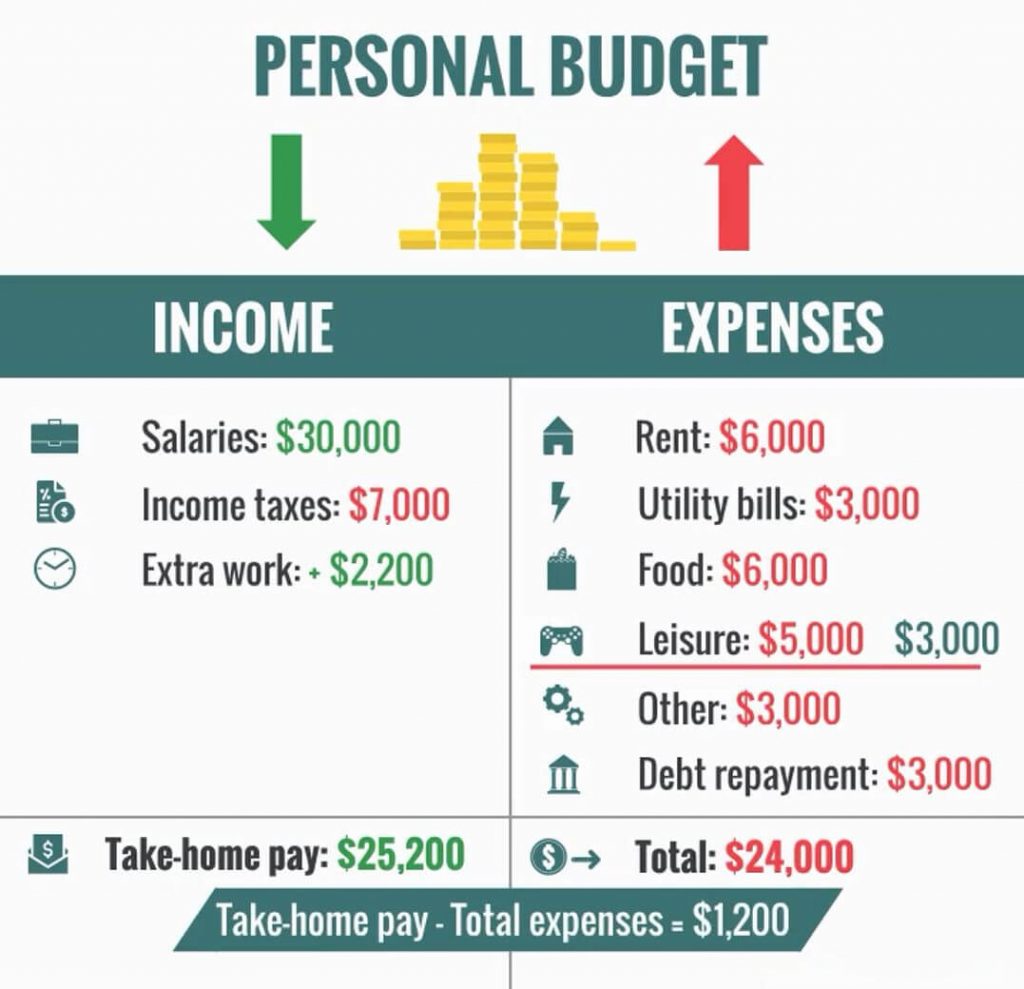

Saving money can seem like a daunting task, but with the right strategies in place, it can become an achievable goal. One effective approach to maximizing your savings is by creating a realistic budget that reflects your financial situation. Start with a comprehensive overview of your income and expenses. Once you have a clear picture, categorize your spending into essentials, such as rent and groceries, and non-essentials, like dining out and entertainment. This structured approach can help you identify areas where you can cut back.

Additionally, implementing the 10 Tips for Smart Budgeting can further enhance your savings efforts:

- Set clear financial goals.

- Track your expenses diligently.

- Use budgeting apps for convenience.

- Automate your savings.

- Review and adjust your budget regularly.

- Limit impulse purchases.

- Take advantage of discounts and cashback offers.

- Plan meals to reduce grocery bills.

- Consider a side hustle for extra income.

- Stay committed and patient.

If you're looking for great sound quality without breaking the bank, check out the Top 10 budget earbuds available today. These selections provide a fantastic listening experience and various features to fit your needs, all while being easy on your wallet. Whether you prioritize battery life, comfort, or sound clarity, there's something for everyone in this list.

The Common Budgeting Mistakes You're Probably Making

Budgeting is an essential skill that can significantly impact your financial well-being, yet many individuals still fall into common traps that hinder their success. One of the common budgeting mistakes is failing to set realistic goals. When your financial ambitions exceed your current financial situation, it can lead to frustration and a lack of adherence to your budget. Instead, focus on creating achievable targets by breaking your goals into specific categories like saving for emergencies, paying off debt, and planning for future expenses.

Another prevalent budgeting mistake is not tracking your actual spending against your budgeted amounts. Many people create a budget but don’t follow up on it, leading to overspending in certain areas. This overspending can erode your financial plan and sabotage your goals. To avoid this mistake, regularly review your expenditures and make adjustments as needed. Additionally, consider utilizing budgeting apps or spreadsheets to keep your finances organized and transparent.

How to Create a Realistic Budget That Works for You

Creating a realistic budget is essential for managing your finances effectively. Start by assessing your monthly income and expenses. Make a list of all sources of income, including salaries, freelance earnings, and any side hustles. Next, categorize your expenses into fixed costs, such as rent and utilities, and variable costs, like groceries and entertainment. This clear breakdown will help you identify areas where you can cut back and allocate more funds toward savings or debt repayment.

Once you have a comprehensive overview of your financial situation, it's time to set specific financial goals. These could be short-term objectives like saving for a vacation or long-term targets such as building a retirement fund. To keep yourself accountable, consider using budgeting tools or apps that allow you to track your spending in real-time. Remember, the key to a successful budget is consistency, so review and adjust your budget regularly to reflect any changes in your lifestyle or financial circumstances.