The Sweet Life of Bettajelly

Exploring delicious recipes, fun food trends, and lifestyle tips that bring joy to your everyday.

Marketplace Liquidity Models that Keep You on Your Toes

Discover innovative marketplace liquidity models that challenge the status quo and keep you ahead. Dive in for insights that spark success!

Understanding Marketplace Liquidity: Key Models to Boost Your Strategy

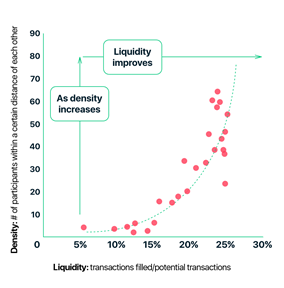

Understanding Marketplace Liquidity is crucial for any business looking to optimize their trading strategies. Liquidity refers to how easily assets can be bought and sold within a marketplace without significantly impacting their price. There are several key models that define liquidity, including the Order Book Model, where buyers and sellers place orders to trade at specific prices, and the Market Maker Model, which involves intermediaries that provide liquidity by being ready to buy and sell at any time. By recognizing these models, businesses can better align their strategies to improve liquidity and enhance market efficiency.

One effective approach to boost your strategy is to apply the Liquidity Pool Model. In this model, pools of capital are created to facilitate trades and reduce volatility. This allows for smoother transactions, ultimately benefiting traders and investors alike. Additionally, understanding Market Depth can provide insights into liquidity, as it showcases the number of buy and sell orders at various price levels. By leveraging these models, businesses can craft robust strategies that ensure improved liquidity, allowing them to navigate market fluctuations with confidence.

Counter-Strike is a popular first-person shooter game that has captivated millions of players worldwide. The game features two opposing teams, terrorists and counter-terrorists, who compete to complete objectives or eliminate each other. For players looking to enhance their gaming experience, using a daddyskins promo code can provide exciting in-game items.

The Importance of Liquidity in Marketplaces: Are You Keeping Up?

Liquidity plays a crucial role in the efficiency of marketplaces, impacting not only sellers and buyers but also the overall health of the economic environment. When a marketplace is liquid, it means that assets can be quickly bought or sold without causing significant price fluctuations. This liquidity is essential for maintaining stability and trust among participants. In contrast, illiquid markets can lead to price manipulation, increased volatility, and a general hesitance among traders. Therefore, understanding and embracing the dynamics of liquidity is vital for anyone looking to thrive in competitive environments.

Modern traders must ask themselves: Are you keeping up with the demands for liquidity in your respective markets? With the rise of high-frequency trading and automated platforms, the pace of transactions has accelerated, making it imperative for participants to adapt quickly. To stay competitive, consider implementing tools that enhance your operation's liquidity, such as real-time monitoring tools and liquidity pools. Additionally, engaging in community discussions and staying informed about market trends can provide valuable insights into optimizing your strategies for better liquidity. Ignoring the importance of liquidity could ultimately hinder your success in the marketplace.

How Do Different Liquidity Models Impact Marketplace Success?

The liquidity model of a marketplace plays a critical role in its overall success by determining how easily buyers and sellers can transact. Different models, such as order book liquidity or pool-based liquidity, can fundamentally alter the user experience and influence trading volume. For instance, an order book model, where active buyers and sellers place their orders, might attract more serious traders due to the transparency and control it provides. On the other hand, a pool-based liquidity model can enhance speed and ease of transactions, appealing to those who prefer a seamless trading experience. Understanding how these models work and their impacts can help operators design better user experiences.

Furthermore, the choice of liquidity model can also affect market stability. A marketplace relying on a high number of active participants within its liquidity pools may experience less price volatility, making it more attractive to long-term investors. Conversely, low liquidity can lead to large price fluctuations, deterring participation. This dynamic is particularly relevant for niche and emerging marketplaces, which must carefully consider their liquidity strategy to ensure sustainable growth and user trust. In conclusion, selecting the right liquidity model is essential for a marketplace aiming to achieve lasting success in a competitive environment.