The Sweet Life of Bettajelly

Exploring delicious recipes, fun food trends, and lifestyle tips that bring joy to your everyday.

Marketplace Liquidity Models: The Unsung Heroes of Trading Success

Uncover the secrets of marketplace liquidity models and discover how they drive trading success. Don’t miss these vital insights!

Understanding the Role of Marketplace Liquidity Models in Trading Success

Marketplace liquidity models are crucial in determining how easily assets can be bought or sold in financial markets without causing significant price changes. Understanding the role these models play can be a game changer for traders, as they inform strategies around entry and exit points. High liquidity often enables faster transactions and tighter spreads, providing traders with the flexibility to react quickly to market changes. Conversely, low liquidity can lead to increased volatility and risk, making it essential for traders to gauge liquidity conditions before executing trades.

Moreover, successful traders often use various liquidity indicators to assess the market environment. These indicators can include metrics such as order book depth, trading volume, and bid-ask spreads. By leveraging this data, traders can identify potential opportunities and adapt their strategies accordingly. For instance, a trader might choose to avoid a low liquidity market if they anticipate high volatility, while actively seeking high liquidity environments where they can execute trades more smoothly and with less slippage.

Counter-Strike is a popular multiplayer first-person shooter game that has captivated players around the world. Players can choose to be terrorists or counter-terrorists, engaging in various game modes such as bomb defusal and hostage rescue. For those looking to enhance their gaming experience, using the daddyskins promo code can provide valuable in-game rewards.

How Liquidity Models Enhance Market Efficiency: A Deep Dive

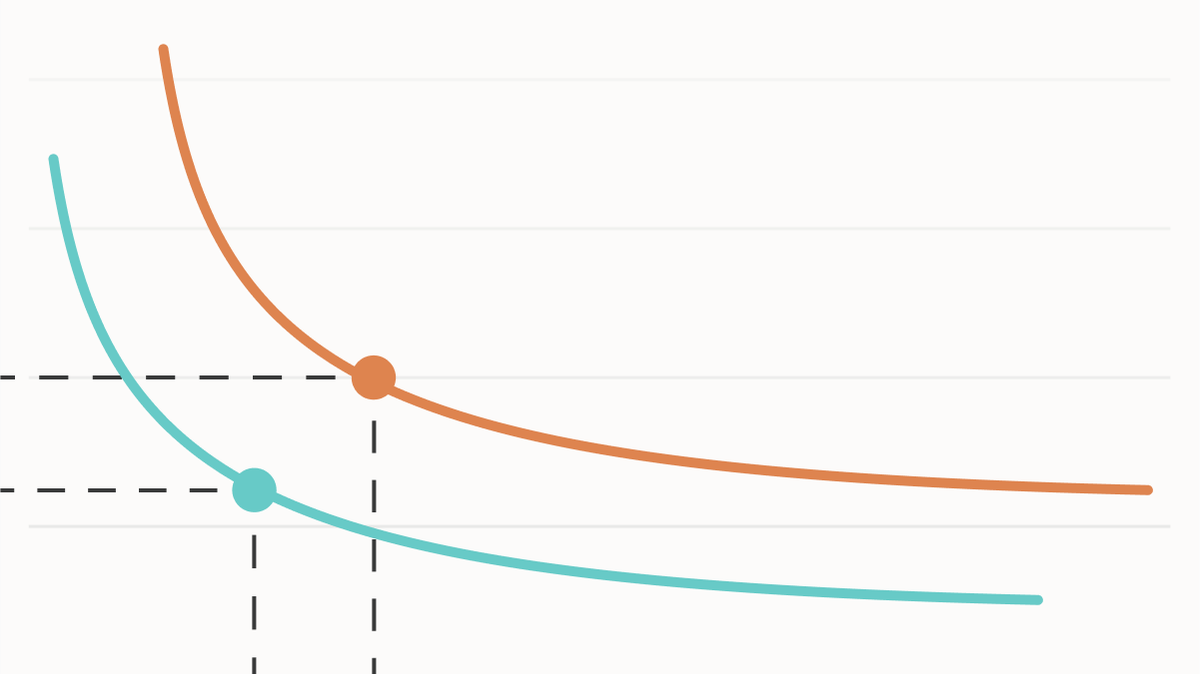

Liquidity models play a crucial role in enhancing market efficiency by providing traders and investors with a clear understanding of the ease with which assets can be bought or sold without causing significant price fluctuations. By quantifying liquidity, these models help identify optimal trading strategies while minimizing transaction costs. For instance, in order-driven markets, liquidity models analyze the relationship between order flow and price dynamics, offering insights that improve decision-making. As a result, market participants can navigate fluctuating conditions more effectively, leading to heightened overall efficiency.

Furthermore, liquidity models foster transparency within the marketplace by enabling real-time monitoring of asset liquidity levels. This transparency aids in minimizing information asymmetry among traders, which can often lead to inefficiencies in trading. Incorporating advanced liquidity metrics, such as the bid-ask spread and order book depth, allows market participants to better assess their positions and execute trades at advantageous prices. As these models evolve, they contribute to more robust market structures that benefit all players, ultimately enhancing the efficiency of the market as a whole.

What Traders Need to Know About Marketplace Liquidity Models

Understanding marketplace liquidity models is crucial for traders aiming to operate efficiently in volatile markets. Liquidity refers to how easily assets can be bought or sold without causing significant price fluctuations. Traders need to familiarize themselves with different liquidity models, such as order book systems and automated market makers (AMMs). An order book system allows traders to see current buying and selling prices, enabling real-time decision-making. In contrast, AMMs use algorithms to price assets, which can lead to increased efficiency but may also introduce risks associated with slippage.

Another important aspect to consider is the impact of liquidity on trading strategies. Liquidity affects transaction costs, execution speed, and overall market depth. Traders utilizing high-frequency strategies will benefit significantly from environments with greater liquidity, as rapid buy and sell orders are more easily executed. On the other hand, long-term investors may need to consider the liquidity of their assets over extended periods, as low liquidity can lead to difficulties when attempting to exit positions smoothly. Ultimately, understanding these models empowers traders to make more informed decisions and adjust their strategies based on current market conditions.